unrealized capital gains tax canada

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. And the tax rate depends on your income.

The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

. In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including. It is a profitable position that has yet to be sold in return for cash such as a. Here is everything you need to know about capital gains tax in Canada so you can stay financially efficient.

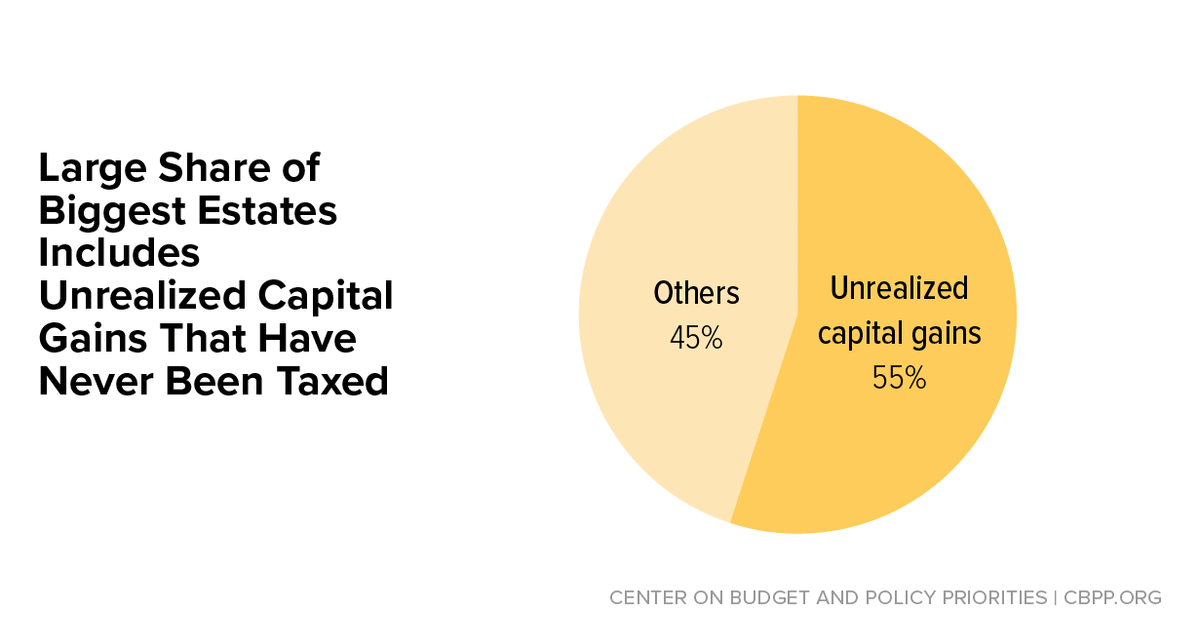

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. The Problems With an Unrealized Capital Gains Tax. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. A capital gains tax is a levy on the profit that an investor makes. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

In Canada only 50 of the capital gain you realize on stocks is taxed the other 50 is yours to keep tax-free. Will the United States implement an unrealized gains tax on cryptocurrency. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

If the proposal were. Canadians pay a 50 tax on all of their capital gains. For example if you were ahead of the curve and bought bitcoin for 100 and.

Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources. For a Canadian who falls in a 33 marginal. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving.

The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital.

To increase their effective tax rate. Loans Lines of Credit. The final dollar amount youll pay will depend on how much.

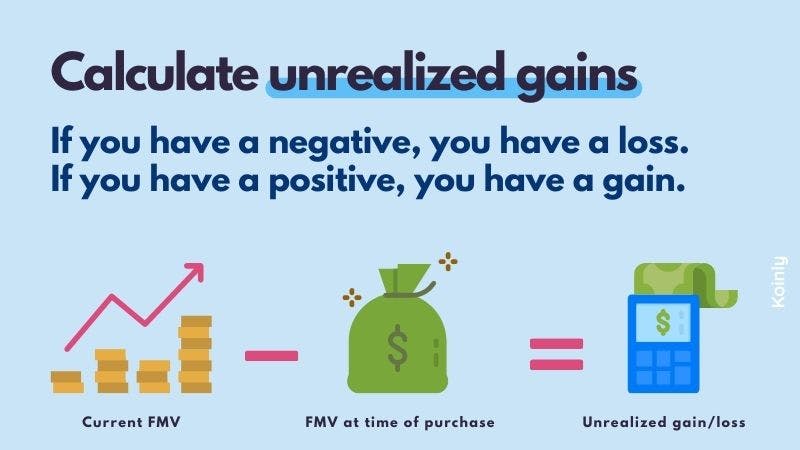

An unrealized gain is a profit that exists on paper resulting from an investment. If you hold an asset for less than one year and sell for a capital gain the. For example if you buy a.

Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. A tax on unrealized gains would harm the economy. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

Billionaire Tax Faces Likely Constitutional Challenge Wsj

Crypto Tax Loss Harvesting Investor S Guide Koinly

Opinion Biden Proposes A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Marketwatch

Opinion Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Marketwatch

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Avoid Capital Gains Tax In Canada In 2022 Finder Canada

Top Democrat Proposes Annual Tax On Unrealized Capital Gains Wsj

4 Tax Myths Of Mutual Funds Debunked Capital Group

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

How Taxes On Capital Gains Work In Canada Capital Gains Income 101 Tax Loss Harvesting Youtube

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

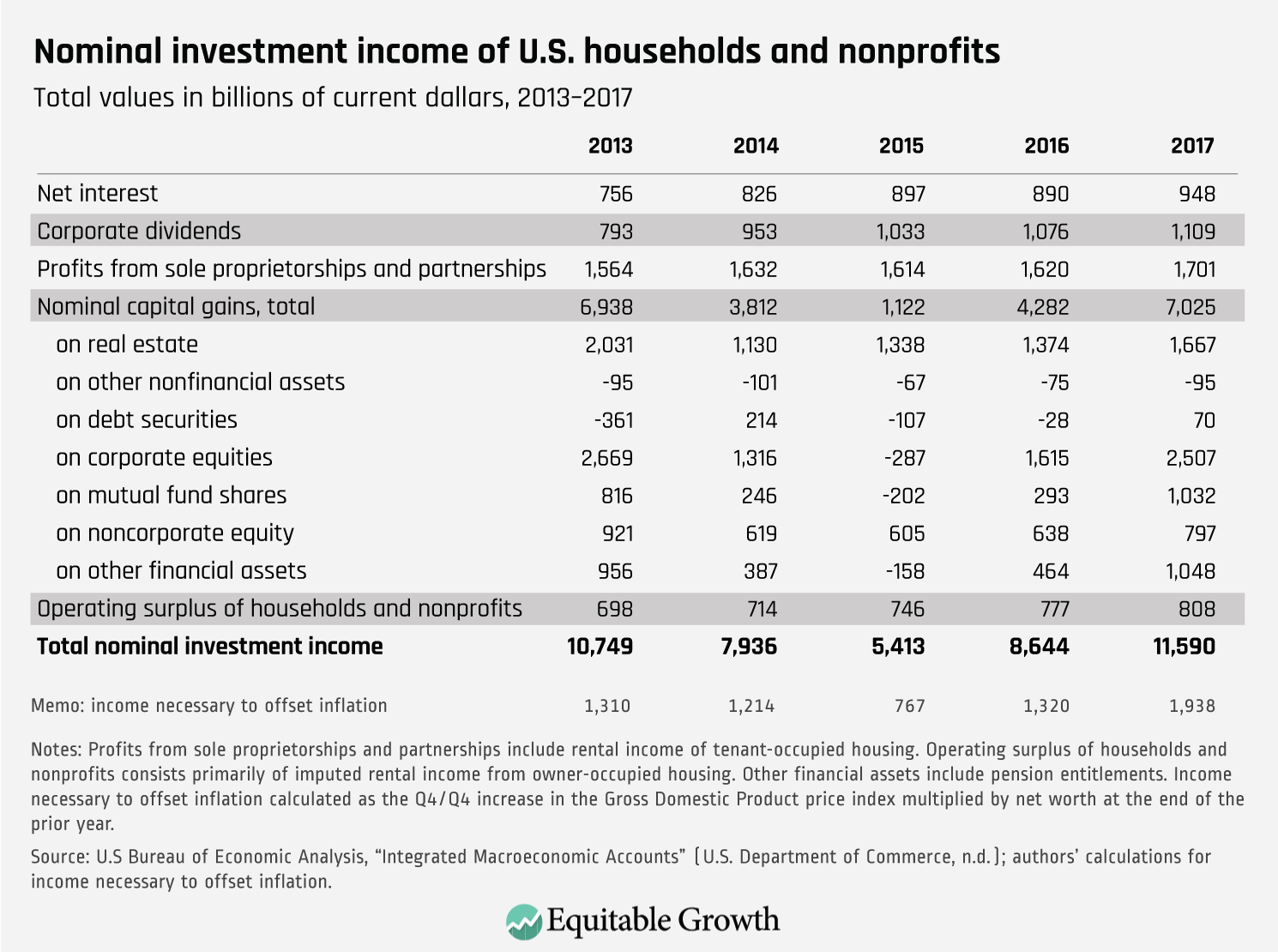

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

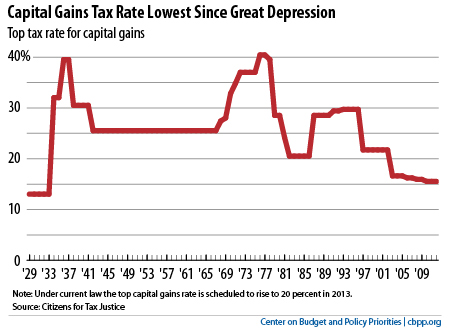

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

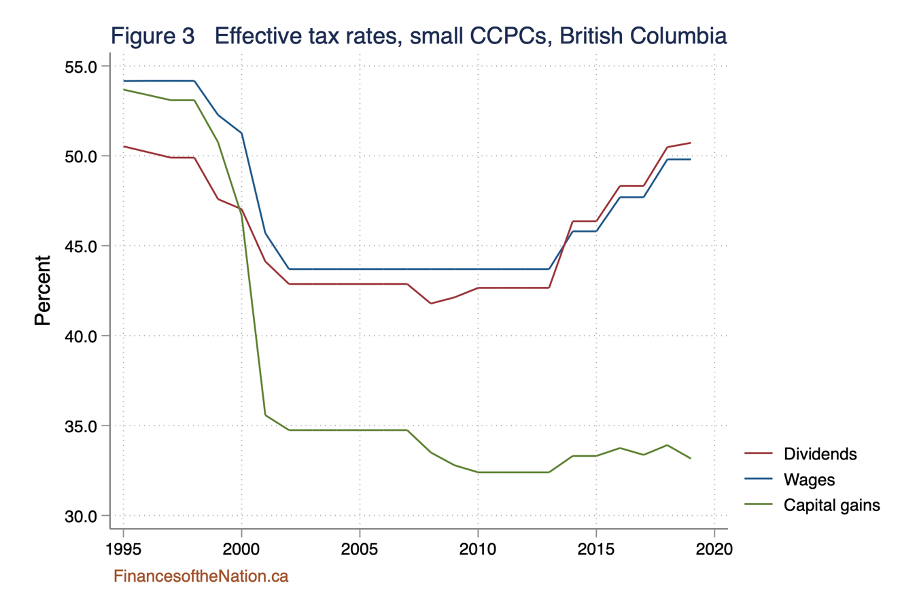

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Capital Gains Tax Hike And More May Come Just After Labor Day